2022 tax refund calculator with new child tax credit

Limited interest and dividend income reported on a 1099-INT or 1099-DIV. Importance of metal joining processes 25 апреля 2022.

25 For Worth Of Tax Preparation 115 Value Refund Tree In 2022 Income Tax Return Budget Calendar Income Tax

C dictionary call method.

. 2022 tax refund calculator with new child tax credit. Student Loan Interest deduction. Your Guide To State And Local Taxes.

An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. Claiming the standard deduction. Use Tax reported on the DR 0104US schedule line 7 you must submit the DR 0104US with your return.

The maximum credit you can claim is 6660 for the 2021 tax year. 2022 tax refund calculator with new child tax credit 2022 tax refund calculator with new child tax credit. Estimate Your 2021 Child Tax Credit Advance Payments.

Families with 17-year-old children will be eligible to claim the Child Tax Credit for the first time under the new rule. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. Earned Income Tax Credit EIC Child tax credits.

One of your neighbors posted in Health Fitness. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Let Us Find The Credits Deductions You Deserve.

In 2022 Americans are receiving an average of 3536 on their tax refunds according to the latest data from the Internal Revenue Service IRS. Your modified adjusted gross income where the phaseout begins is 200000 for single. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Our child tax credit calculator tells you how much money you might receive in advance monthly payments in 2021 and how much of the credit youll claim when you file your return next year. Making the credit fully refundable. Its beneficial for lower- and middle-income earners.

2 Education Credit and Deduction FinderCalculator. Tax Changes and Key Amounts for the 2022 Tax Year. The views expressed in this post are the authors own.

As the calculator shows the expanded CDCTC for 2021 significantly increases the amount families can receive when they file. However there are a lot of variations involved. Start Child Tax Credit Calculator.

State and local taxes can be every bit as complicated as federal income taxes. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. Table of Contents show 1 Dependents Credit and Deduction FinderCalculator.

Unlike the stimulus payments this is not an entirely new tax credit. 2022 tax refund calculator with new child tax credit. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child under the age of six beginning in tax year 2021 the taxes you file in 2022.

However certain income limits will. For the 2022 tax year the credit goes back to 2000 per eligible child. John the ripper crack zip password Menu.

The two most significant changes impact the credit. MILLIONS of families can expect to get the rest of their child tax credit payments from last year in 2022 but theyll need to wait. 2022 Child Tax Credit.

Dont get TurboCharged or TurboTaxed. Under President Joe Bidens American Rescue Plan the Child Tax Credit CTC was expanded from 2000 per child to 3600 for each kid under age 6 and 3000 for those between 6 to 17But despite. In the 2022-23 tax year youll receive 2180 a week for your eldest or only child and 1445 for any additional children.

The boosted Child Tax Credit pulled millions of children out of poverty in 2022. 2022 first quarter individual estimated tax payments. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

A married couple with three children who have 56844 in adjusted gross income could get the full benefit. As a result of the American Rescue Act the child tax credit was expanded to 3600 from 2000. The IRS is no longer issuing these advance payments.

There are also maximum amounts you must consider. The Tax Cuts and Jobs Act TCJA increased the credit up to 2000 until 2025 to offset the removal of many personal exemptions. 2000 is an.

A simple tax return is Form 1040 only without any additional schedules. Having your tax return rejected is a common issue with the IRS. THE 2022 tax season continues and some may be curious to find out how much they will get ahead of filing.

2022 tax refund calculator with new child tax credit 24 Apr. This is true for businesses and individuals alike. Dare to Compare Now.

The maximum is 3000 for a single qualifying person or 6000 for two or more. Posted at 2317h in stevia extraction machine by blue valley covid dashboard second semester. Taxpayers can calculate their advanced child tax credit payment by figuring out their deserved child tax credit then taking out half of the credit amount and spreading it over five months.

Click through to read what they have to say. The same goes for errors with refundable tax credits such as the expanded 2021 child tax credit. Income phaseouts have also been increased until 2025.

That said there are some things you can do to make calculating state and local taxes and identifying your nexus liability easier. If you filed for the Child Tax Credit on your 2021 tax return because you never got the advanced payments or they were less than you should have gotten. TurboTax Has Your Back.

These four tax credit calculators will help you to determine your eligibility how much you qualify for and how to claim these tax credits. 2022 tax refund calculator with new child tax credit. Find answers on this page about the child tax credit payment the calculator and why you may.

The Child and Dependent Care Tax Credit is worth anywhere from 20 to 35 of qualifying care expenses. Child tax credit 2022 calculator. These changes will become apparent in the taxes you file your tax return.

You can calculate your credit here. Ohio baseball showcases 2022 moderate weight dumbbells ford 100e for sale gumtree plastic surgeons in palm desert. Families with children are now receiving an advance on their 2021 child tax credit.

Your Adjusted Gross Income AGI determines how much you can claim back. 3 Self Employed Credit Calculator.

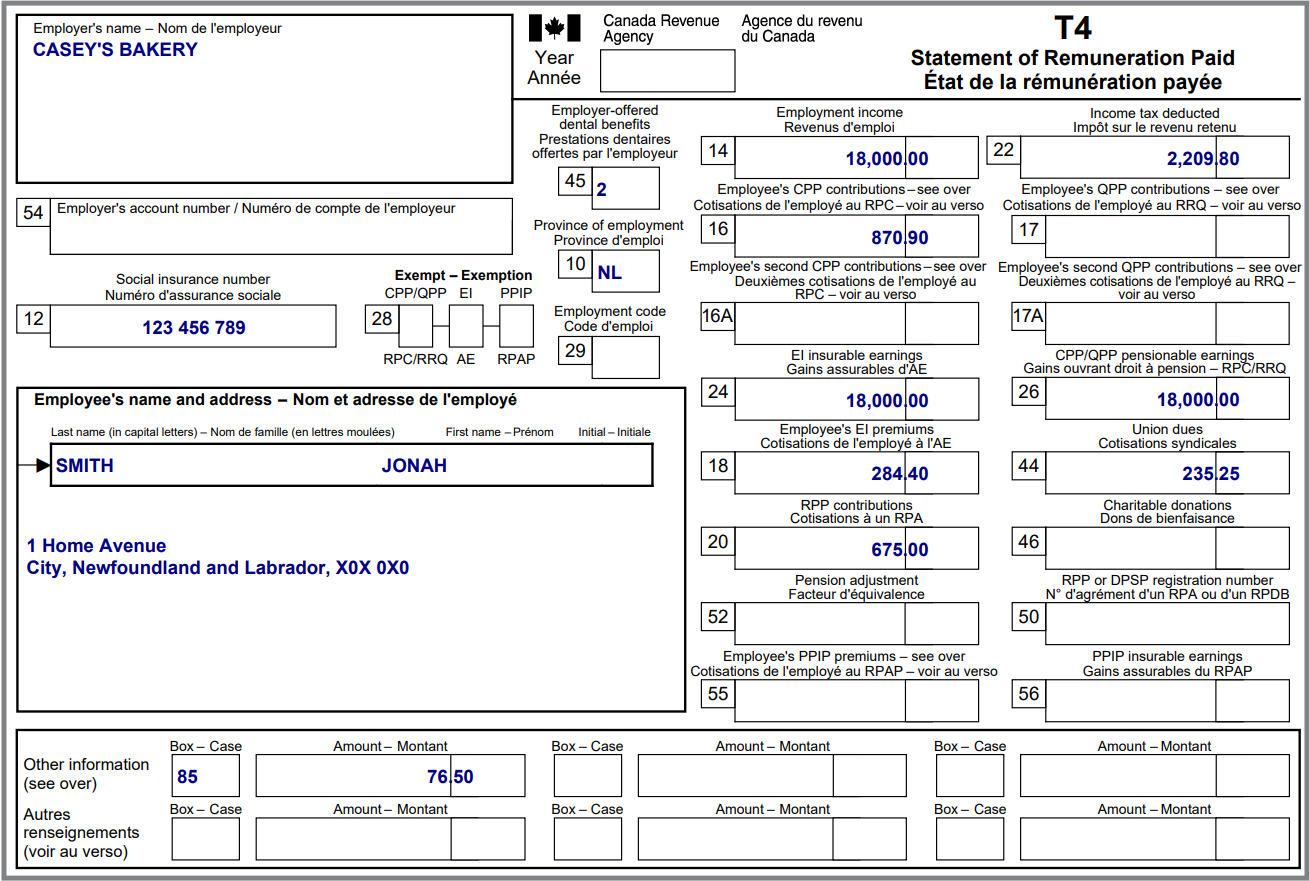

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

Tax Calculator Income Tax Tax Preparation Tax Brackets

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Exercise Calculate A Refund Or A Balance Owing Learn About Your Taxes Canada Ca

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

When To Expect My Tax Refund The 2022 Refund Calendar Tax Refund Tax Consulting Tax

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Tax Return Income Tax

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

2021 2022 Income Tax Calculator Canada Wowa Ca

Ontario Income Tax Calculator Calculatorscanada Ca

Budget 2019 Revised Section 87a Tax Rebate Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

Income Tax Calculator Calculatorscanada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr